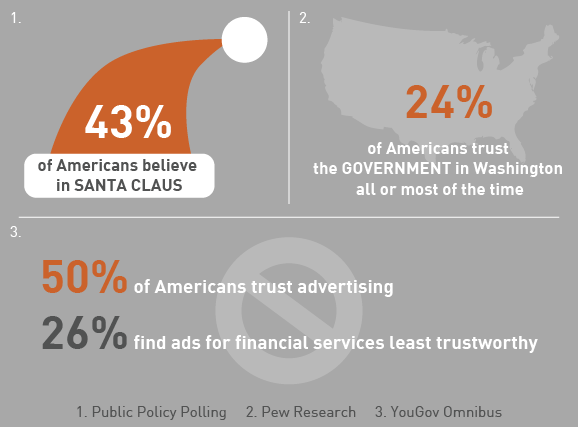

Unbelievable! Marketing to a Skeptical Nation

Americans are a skeptical bunch. While Santa still makes a strong showing, with 43 percent of Americans telling Public Policy Polling they believe, our real live government earns the trust of a meager 24 percent of the public, according to Pew Research. YouGov Omnibus reports that only 50 percent of Americans believe what they see in ads. More troubling, 26 percent of respondents called financial services and insurance companies the least trustworthy advertisers – second only to diet products.

Millennials are frequently singled out as a cynical cohort. And indeed, a generation raised on constant media and ad consumption and an ever-escalating array of new technology is understandably inured to hype. Yet, Millennials aren’t alone in their disbelief: Americans as a whole are over it.

Credit unions face a particular challenge here. The market is jaded, but the credit union message is genuine. Ironically, one of the great advantages credit unions have – their character – isn’t an automatic win in skeptical America. While member-centric values align perfectly with hype-weary consumers, credit unions must tell this story loudly and convincingly in order to make an impact.

How do you break through the disbelief?

State the facts. You may, in fact, have the best mobile app or friendliest service staff in the known galaxy. Still, don’t go there. Base your promotion on fact: Your mobile banking app has these five standout features. Your friendly staffers helped 2,365 members lower their credit card rates this year. Important: Make sure the facts you’re promoting are actually true.

Don’t overstate. In fact, try understating. Skeptical consumers are more likely to buy in to a financial institution with service they’ll like (not loooooooove), tools that work (not overwhelm) and motives they’ll recognize (not sing about). Today, typical consumers get custom-made dog food delivered to their doorsteps, carry phones that can monitor their every health function and give directly to indie causes they care about on social media. Their everyday reality is fantastic. If you live up to their expectations – instead of promising to bowl them over – you’ll actually be doing a lot.

Deliver. Failing to deliver is simply the worst. Make sure “upgraded” technology is better, not buggy. Make sure your outstanding personalized service doesn’t shut down on weekends. If being a not-for-profit allows you to offer lower rates and fees for members, show people how.

Believe. Hyping your credit union won’t get you far in this environment, but believing in yourself might. Find the simple, fundamental, ongoing reasons why your credit union works for your members. Then spend every day in 2015 reminding yourself, your team, your members and your market why these reasons are true. You don’t need hyperbole, just conviction.