Is the Internet of Financial Things a Thing?

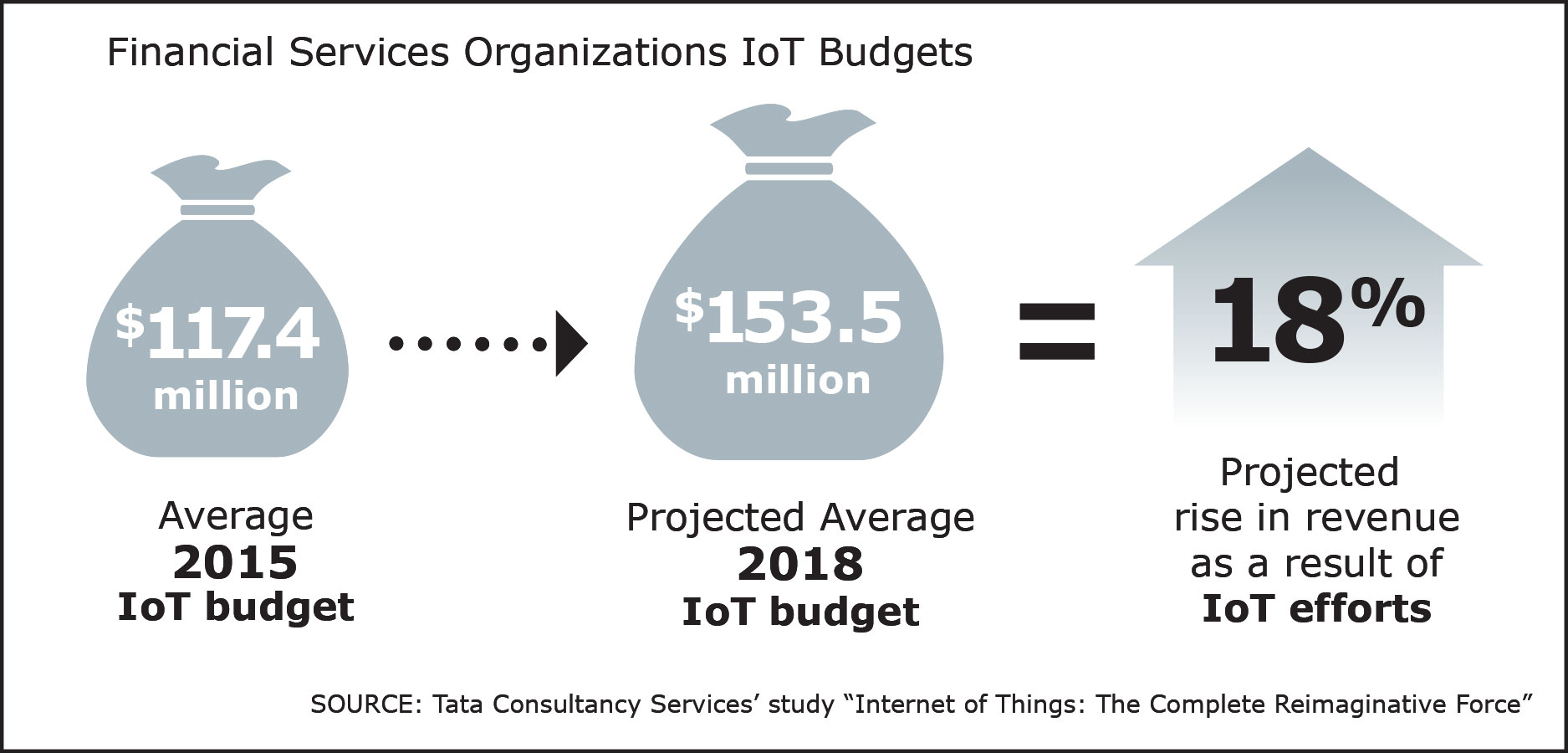

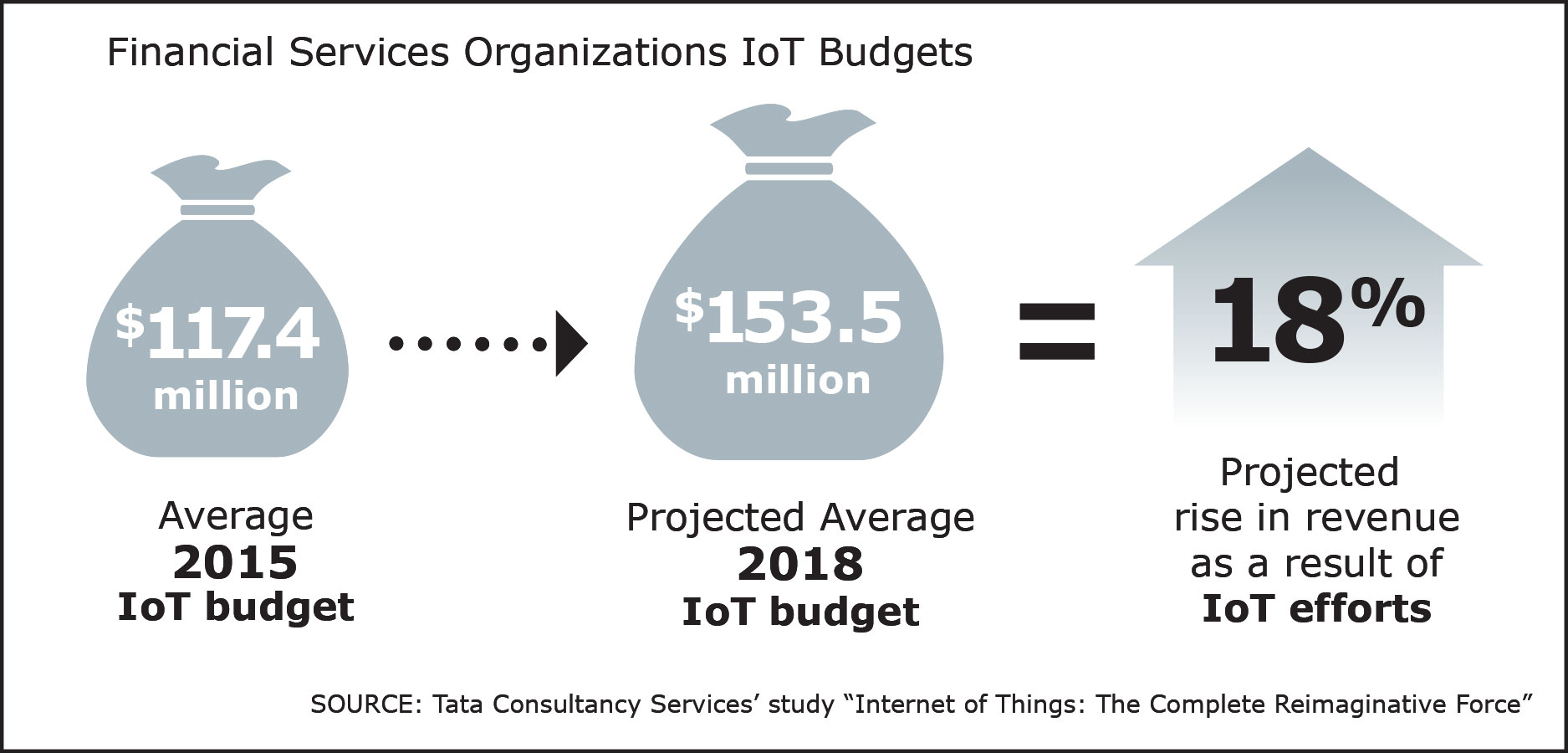

The Internet of Things (IoT) is changing everything – and that includes the way we all handle our money. This trend certainly isn’t lost on financial services companies, which reported an average annual IoT budget of $117.4 million for 2015 in Tata Consultancy Services’ study “Internet of Things: The Complete Reimaginative Force.” The same companies project they’ll be spending $153.5 million by 2018, and that their IoT initiatives will reap an 18% increase in revenue over the next three years.

Yet, when we consider the Internet of Things’ impact on financial services, it’s clear that this won’t be the same kind of revolution we’re seeing in, say, home security or health monitoring.

Why not? When we speak about things like home security or personal health, there’s usually something tangible involved. A video doorbell, for example, is helpful because it’s monitoring the physical space around your front door. Want to see who’s ringing your door while you’re at work or on vacation in Bermuda? If you’ve hooked up a video doorbell, you have a “thing” to do precisely that.

Similarly, connected health devices monitor your physical condition. That’s not the case with most smart devices – new or established – that monitor and maintain your financial health. Even now, in the last moments of the pre-IoT era, our experiences with money are largely virtual. In fact, chances are good that you already monitor your financial health via mobile device, and that you’ve done so for a long time. Who needs the Internet of Things when you already have a constant connection to your accounts and transactions?

Not so fast

The answer, of course, is everybody. Once the world gets a load of ambient connectivity; secure, immersive experiences; a near-infinite capacity to monitor remote environments; and the pervasive sense that we can cheat time and space, all of our expectations will shift.

But, at least in the foreseeable future, the IoT revolution probably won’t be about “things” for financial services. Though we’ve seen some cool gadgets, the likelihood that your local credit union will be going into the business of gadget development is slim.

Where IoT is more likely to strike is in the evolution of access. Financial services may already have established inroads into the world of connectedness (they introduced the ATM decades ago), but with the growth of IoT, speed and availability are the new issues. Here are just a few innovations that speak to the changes to come:

Yet, when we consider the Internet of Things’ impact on financial services, it’s clear that this won’t be the same kind of revolution we’re seeing in, say, home security or health monitoring.

Why not? When we speak about things like home security or personal health, there’s usually something tangible involved. A video doorbell, for example, is helpful because it’s monitoring the physical space around your front door. Want to see who’s ringing your door while you’re at work or on vacation in Bermuda? If you’ve hooked up a video doorbell, you have a “thing” to do precisely that.

Similarly, connected health devices monitor your physical condition. That’s not the case with most smart devices – new or established – that monitor and maintain your financial health. Even now, in the last moments of the pre-IoT era, our experiences with money are largely virtual. In fact, chances are good that you already monitor your financial health via mobile device, and that you’ve done so for a long time. Who needs the Internet of Things when you already have a constant connection to your accounts and transactions?

Not so fast

The answer, of course, is everybody. Once the world gets a load of ambient connectivity; secure, immersive experiences; a near-infinite capacity to monitor remote environments; and the pervasive sense that we can cheat time and space, all of our expectations will shift.

But, at least in the foreseeable future, the IoT revolution probably won’t be about “things” for financial services. Though we’ve seen some cool gadgets, the likelihood that your local credit union will be going into the business of gadget development is slim.

Where IoT is more likely to strike is in the evolution of access. Financial services may already have established inroads into the world of connectedness (they introduced the ATM decades ago), but with the growth of IoT, speed and availability are the new issues. Here are just a few innovations that speak to the changes to come:

Yet, when we consider the Internet of Things’ impact on financial services, it’s clear that this won’t be the same kind of revolution we’re seeing in, say, home security or health monitoring.

Why not? When we speak about things like home security or personal health, there’s usually something tangible involved. A video doorbell, for example, is helpful because it’s monitoring the physical space around your front door. Want to see who’s ringing your door while you’re at work or on vacation in Bermuda? If you’ve hooked up a video doorbell, you have a “thing” to do precisely that.

Similarly, connected health devices monitor your physical condition. That’s not the case with most smart devices – new or established – that monitor and maintain your financial health. Even now, in the last moments of the pre-IoT era, our experiences with money are largely virtual. In fact, chances are good that you already monitor your financial health via mobile device, and that you’ve done so for a long time. Who needs the Internet of Things when you already have a constant connection to your accounts and transactions?

Not so fast

The answer, of course, is everybody. Once the world gets a load of ambient connectivity; secure, immersive experiences; a near-infinite capacity to monitor remote environments; and the pervasive sense that we can cheat time and space, all of our expectations will shift.

But, at least in the foreseeable future, the IoT revolution probably won’t be about “things” for financial services. Though we’ve seen some cool gadgets, the likelihood that your local credit union will be going into the business of gadget development is slim.

Where IoT is more likely to strike is in the evolution of access. Financial services may already have established inroads into the world of connectedness (they introduced the ATM decades ago), but with the growth of IoT, speed and availability are the new issues. Here are just a few innovations that speak to the changes to come:

Yet, when we consider the Internet of Things’ impact on financial services, it’s clear that this won’t be the same kind of revolution we’re seeing in, say, home security or health monitoring.

Why not? When we speak about things like home security or personal health, there’s usually something tangible involved. A video doorbell, for example, is helpful because it’s monitoring the physical space around your front door. Want to see who’s ringing your door while you’re at work or on vacation in Bermuda? If you’ve hooked up a video doorbell, you have a “thing” to do precisely that.

Similarly, connected health devices monitor your physical condition. That’s not the case with most smart devices – new or established – that monitor and maintain your financial health. Even now, in the last moments of the pre-IoT era, our experiences with money are largely virtual. In fact, chances are good that you already monitor your financial health via mobile device, and that you’ve done so for a long time. Who needs the Internet of Things when you already have a constant connection to your accounts and transactions?

Not so fast

The answer, of course, is everybody. Once the world gets a load of ambient connectivity; secure, immersive experiences; a near-infinite capacity to monitor remote environments; and the pervasive sense that we can cheat time and space, all of our expectations will shift.

But, at least in the foreseeable future, the IoT revolution probably won’t be about “things” for financial services. Though we’ve seen some cool gadgets, the likelihood that your local credit union will be going into the business of gadget development is slim.

Where IoT is more likely to strike is in the evolution of access. Financial services may already have established inroads into the world of connectedness (they introduced the ATM decades ago), but with the growth of IoT, speed and availability are the new issues. Here are just a few innovations that speak to the changes to come:

- Real-time payments. P2P is already a given, but in the IoT universe, electronic payments should transact instantaneously.

- Alerts and more alerts. Just as a health monitor provides instant feedback, so should triggers on one’s accounts. Apps like CardNav, which send spending or security alerts to a user’s mobile device based on real-time data, create a sense of constant connectivity.

- Alternative ATM access. As mobile payments take root, mobile-based ATM access seems inevitable.

- Digital wallets such as Apple Pay™ and Android™ Pay. Fast, cardless transactions with heightened security are now a reality.

- Effortless security. Keeping member information – and money, for that matter – secure as connection points proliferate is not an easy task. But that doesn’t prevent consumers from expecting better, more powerful and less mindful security.